Achieves 7.7% Net Sales Growth in the Quarter

BLOOMFIELD HILLS, Michigan, October 26, 2023 - TriMas (NASDAQ: TRS) today announced financial results for the third quarter ended September 30, 2023.

TriMas Third Quarter Highlights

- Achieved net sales of $235.3 million, or growth of 7.7%, compared to the prior year quarter

- Improved margin levels within the TriMas Packaging group through enhanced cost savings efforts

- Increased net sales within the TriMas Aerospace and TriMas Specialty Products groups by 48.8% and 18.1%, respectively, compared to third quarter 2022

- Increased diluted EPS by 25.0% to $0.40 and adjusted diluted EPS(2) by 42.5% to $0.57, compared to the prior year quarter

Third Quarter 2023

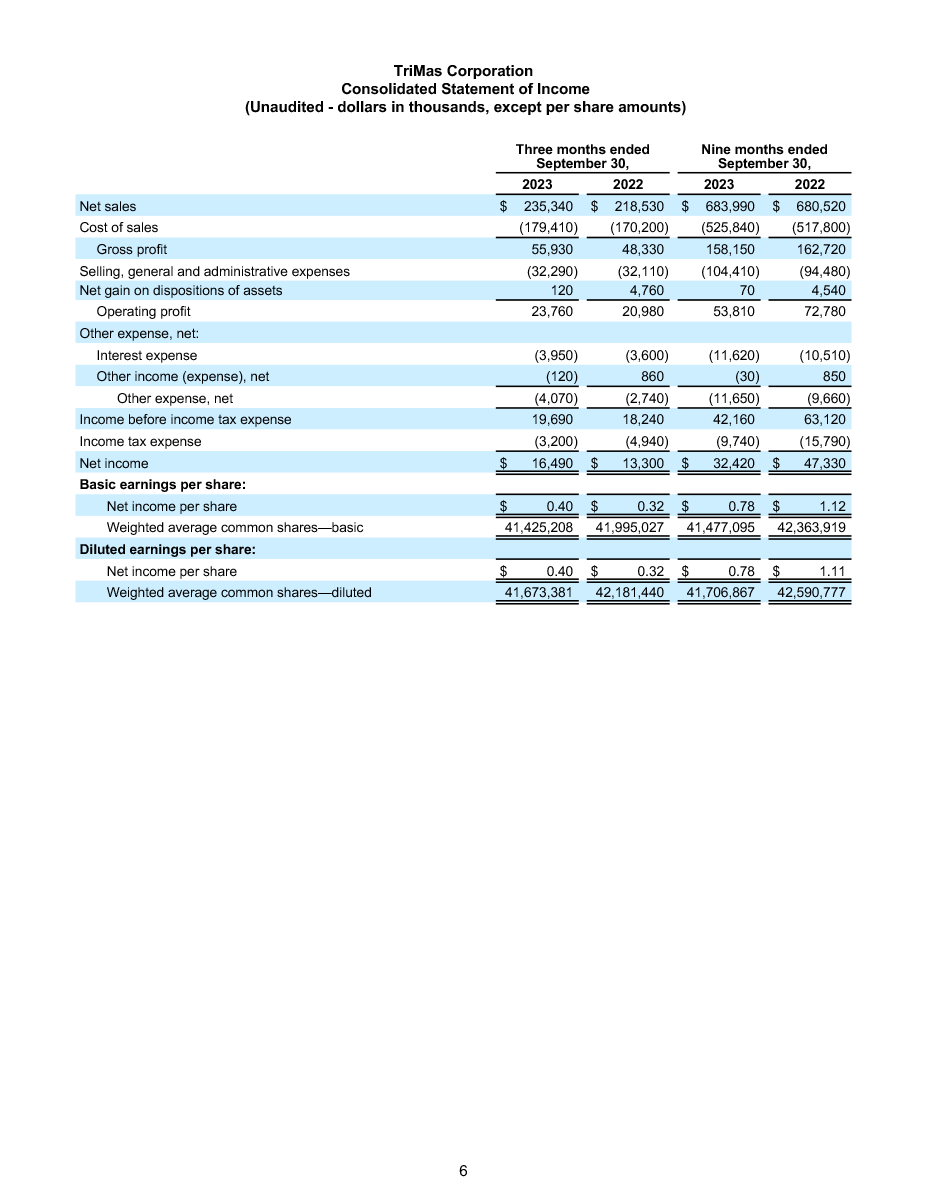

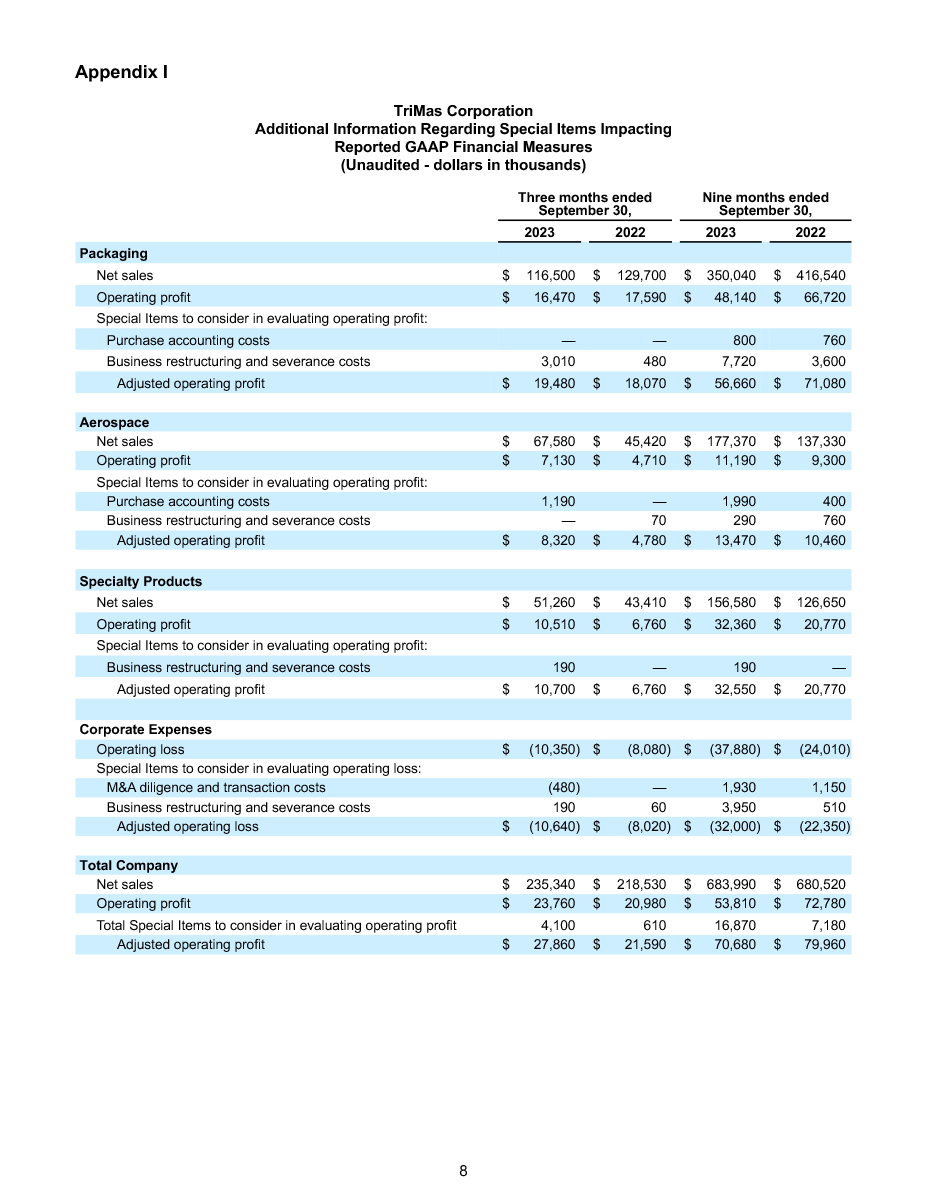

TriMas reported third quarter 2023 net sales of $235.3 million, an increase of 7.7% compared to $218.5 million in third quarter 2022, as organic growth in the TriMas Specialty Products and TriMas Aerospace groups, and acquisition-related sales, more than offset lower market demand for TriMas Packaging's dispensing and closure products, primarily used in personal care, food and industrial applications. The Company reported operating profit of $23.8 million in third quarter 2023, an increase of $2.8 million, or 13.3%, compared to $21.0 million in third quarter 2022. Adjusting for Special Items(1), third quarter 2023 adjusted operating profit was $27.9 million, an increase of $6.3 million, or 29.0%, compared to $21.6 million in the prior year period, primarily as a result of higher sales volumes, the impact of recent acquisitions and improvements in operational efficiency in TriMas Aerospace.

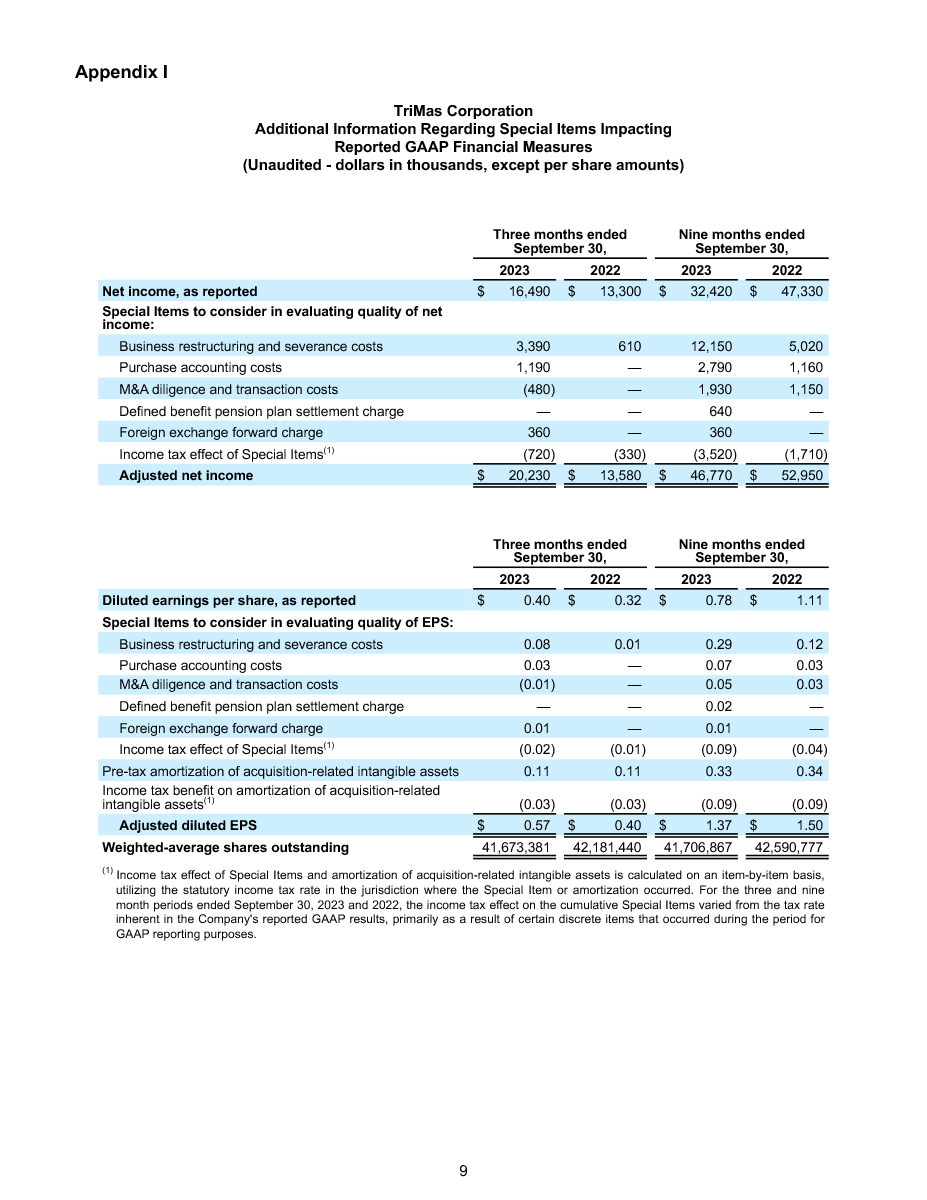

The Company reported third quarter 2023 net income of $16.5 million, or $0.40 per diluted share, compared to $13.3 million, or $0.32 per diluted share, in third quarter 2022, an increase of $3.2 million, or 24.0%. Adjusting for Special Items(1), third quarter 2023 adjusted net income(2) was $20.2 million, an increase of $6.7 million, or 49.0%, compared to $13.6 million in third quarter 2022, primarily as a result of higher operating profit in third quarter 2023 and the successful completion of a tax planning project. Third quarter 2023 adjusted diluted earnings per share(2) was $0.57, an increase of 42.5% compared to $0.40 in the prior year period.

"Our third quarter results were catalyzed by proactive cost savings initiatives within our TriMas Packaging group and intensive operational improvements within our TriMas Aerospace group, which aided our ability to achieve adjusted diluted EPS(2) growth of 42.5% and top-line growth of 7.7%, compared to third quarter 2022," said Thomas Amato, TriMas President and Chief Executive Officer. "We delivered significantly improved performance within our TriMas Aerospace group, as we made progress bringing our critical sub-supply and skilled labor constraints into better alignment with higher demand, which begins to position us well for 2024. Additionally, our TriMas Specialty Products group continued to capitalize on our earlier manufacturing investments to improve conversion."

“With respect to our TriMas Packaging group, we remain encouraged about our future due to the introduction of several innovative, new products, as well as the increased commercial activity underway. While we have successfully secured multiple meaningful programs, and are diligently working to close others, the benefits from these endeavors will not materialize until 2024, considering the current time of year. Although the market recovery has proven to be longer than we anticipated at the start of the year, our cost savings initiatives have significantly bolstered our operating margins compared to the previous year, although we are still operating below the group's full potential, especially in a higher-demand environment.”

"TriMas' ability to consistently generate compelling annual cash flow empowers us to continue investing in innovation, distributing dividends, opportunistically repurchasing shares and actively pursuing acquisitions. As we look forward to 2024 and beyond, we are confident that TriMas’ diversified end market model, strong balance sheet and cash generation profile, and dedicated global workforce will continue to provide compelling value-creating opportunities," concluded Amato.

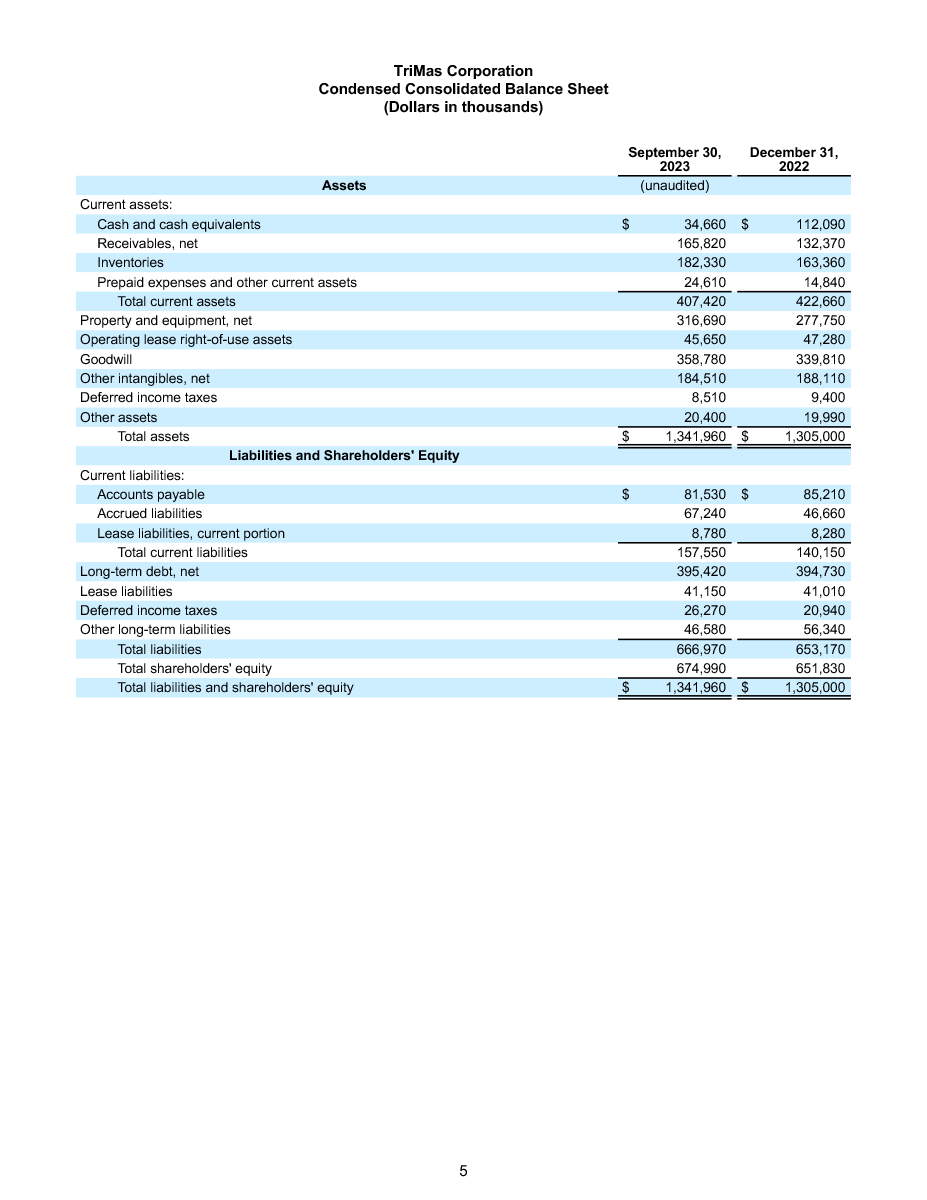

Financial Position

During the first nine months of 2023, the Company paid cash of $77.3 million for acquisitions and repurchased 462,388 shares of its outstanding common stock for $13.4 million, further reducing net shares outstanding by approximately 0.7%. TriMas also paid a quarterly cash dividend of $0.04 per share of TriMas Corporation stock during each of the first three quarters of 2023, as well as declared a $0.04 per share dividend to be payable on November 9, 2023.

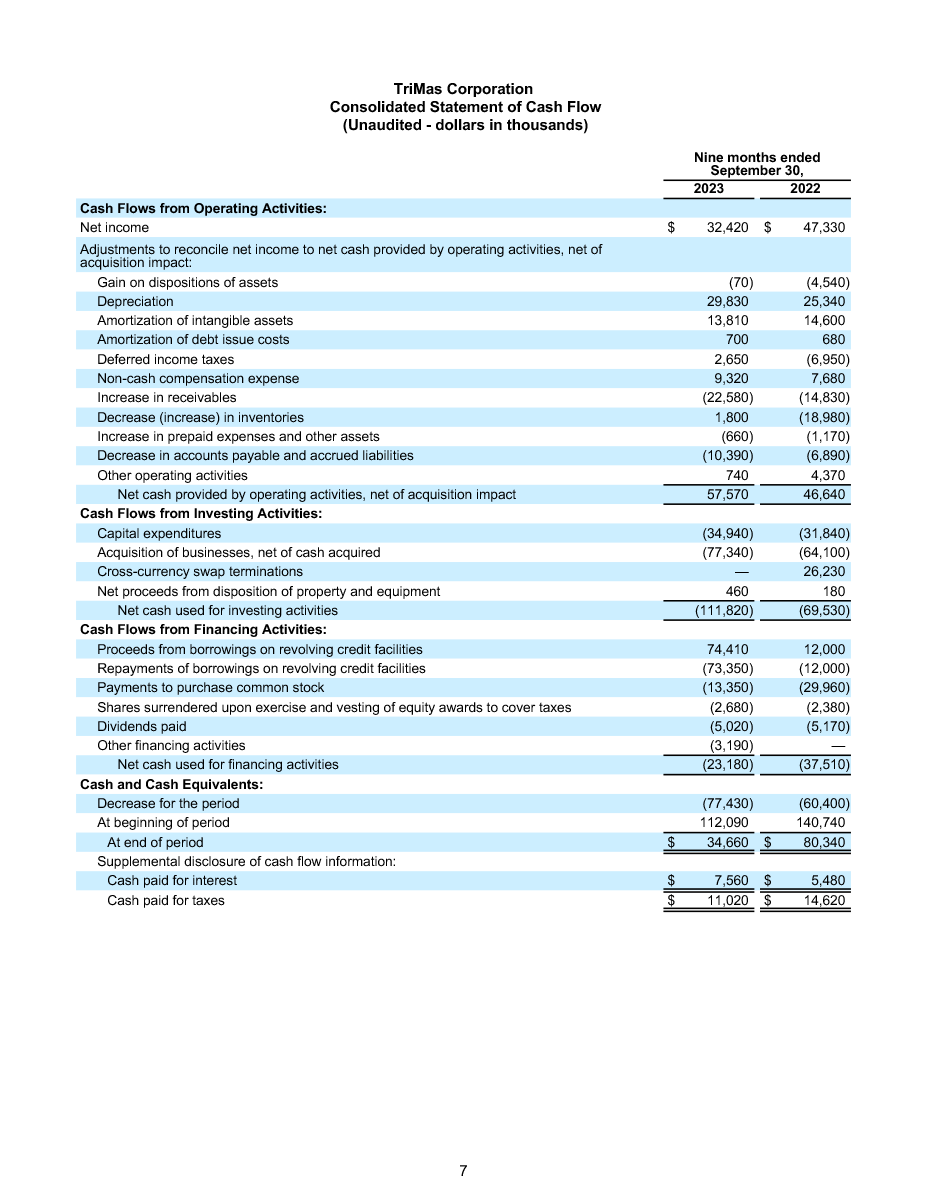

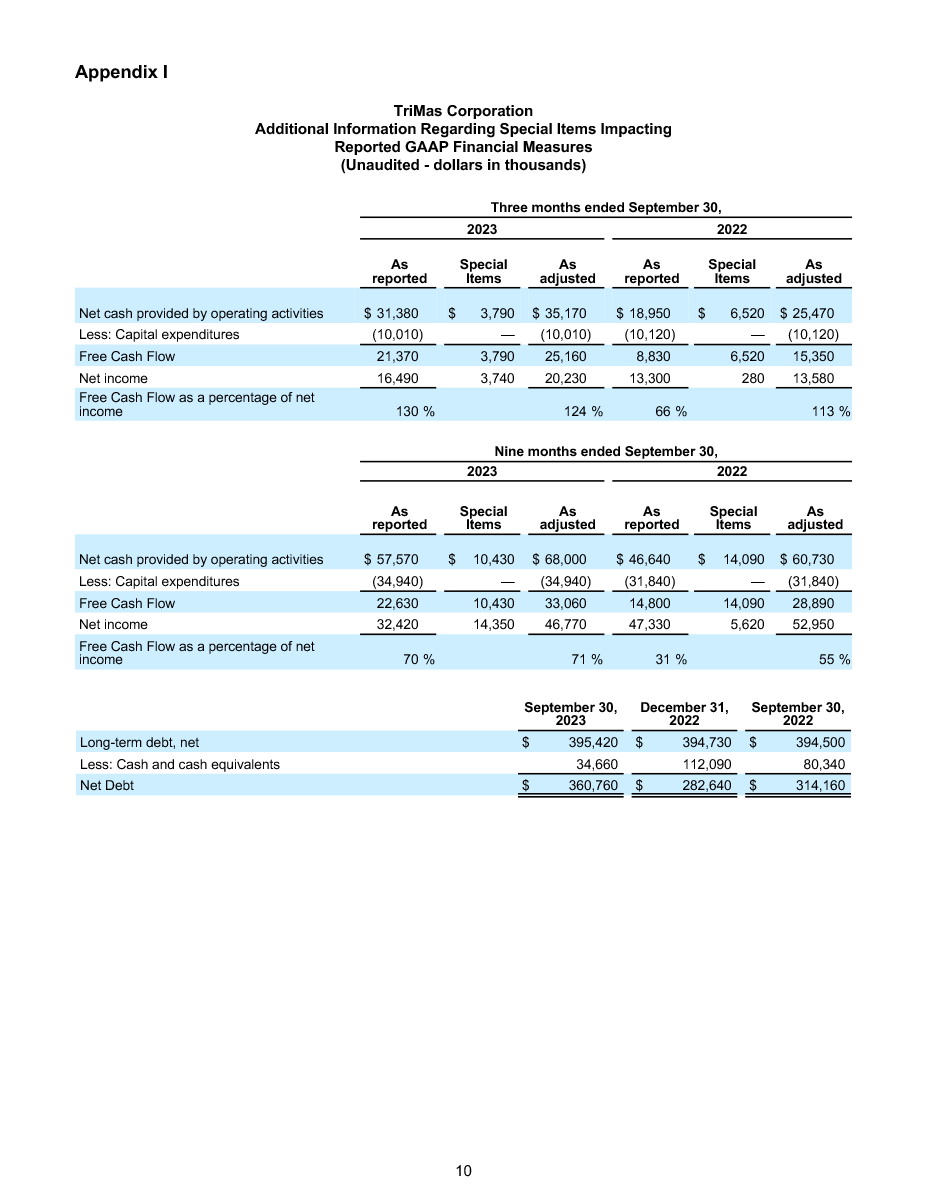

TriMas ended third quarter 2023 with $34.7 million of cash on hand, $312.3 million of cash and available borrowing capacity under its revolving credit facility, and a net leverage ratio of 2.3x as defined in the Company's credit agreement. As of September 30, 2023, TriMas reported total debt of $395.4 million and Net Debt(3) of $360.8 million. The Company continues to maintain a strong balance sheet and remains committed to its cash allocation strategy of investing in its businesses, managing debt levels, returning capital to shareholders through both share buybacks and dividends, and augmenting organic growth through programmatic bolt-on acquisitions.

The Company reported net cash provided by operating activities of $31.4 million for third quarter 2023, compared to $19.0 million in third quarter 2022. As a result, the Company reported Free Cash Flow(4) of $25.2 million for third quarter 2023, compared to $15.4 million in third quarter 2022. Please see Appendix I for further details.

Third Quarter Segment Results

TriMas Packaging group's net sales for the third quarter were $116.5 million, a decrease of 10.2% compared to the year ago period, as organic growth within its Life Sciences business and sales from the recent acquisition were more than offset by lower market demand, as anticipated, for dispensers used in personal care applications and closures used in food and industrial applications. Third quarter operating profit margin percentage improved, as the group's cost savings initiatives more than offset the impacts of lower sales levels and the decision to retain certain skilled labor and other positions in anticipation of a market recovery. During the quarter, the Company completed all production activities and relocated certain key assets from its Rohnert Park, California, and Hangzhou, China, plants. The Company continues to actively engage with its customers to evaluate longer-term demand requirements and is prepared to take appropriate incremental manufacturing and other cost savings actions, as necessary.

TriMas Aerospace group's net sales for the third quarter were $67.6 million, an increase of 48.8% compared to the year ago period, primarily driven by increased aerospace production demand, reduced production constraints and acquisition-related sales. Third quarter operating profit and the related margin percentage increased, primarily due to operational excellence initiatives, higher sales levels and a favorable product sales mix.

TriMas Specialty Products group's net sales were $51.3 million, an increase of 18.1% compared to the year ago period, primarily due to higher demand for steel cylinders used in construction and HVAC applications, as well as increased sales of stationary power generation and compressor units, as demand for locally-provided products increased in certain U.S. industrial markets. Third quarter operating profit and the related margin percentage increased, as a result of prior operational excellence actions, combined with a robust demand environment through the third quarter.

Outlook

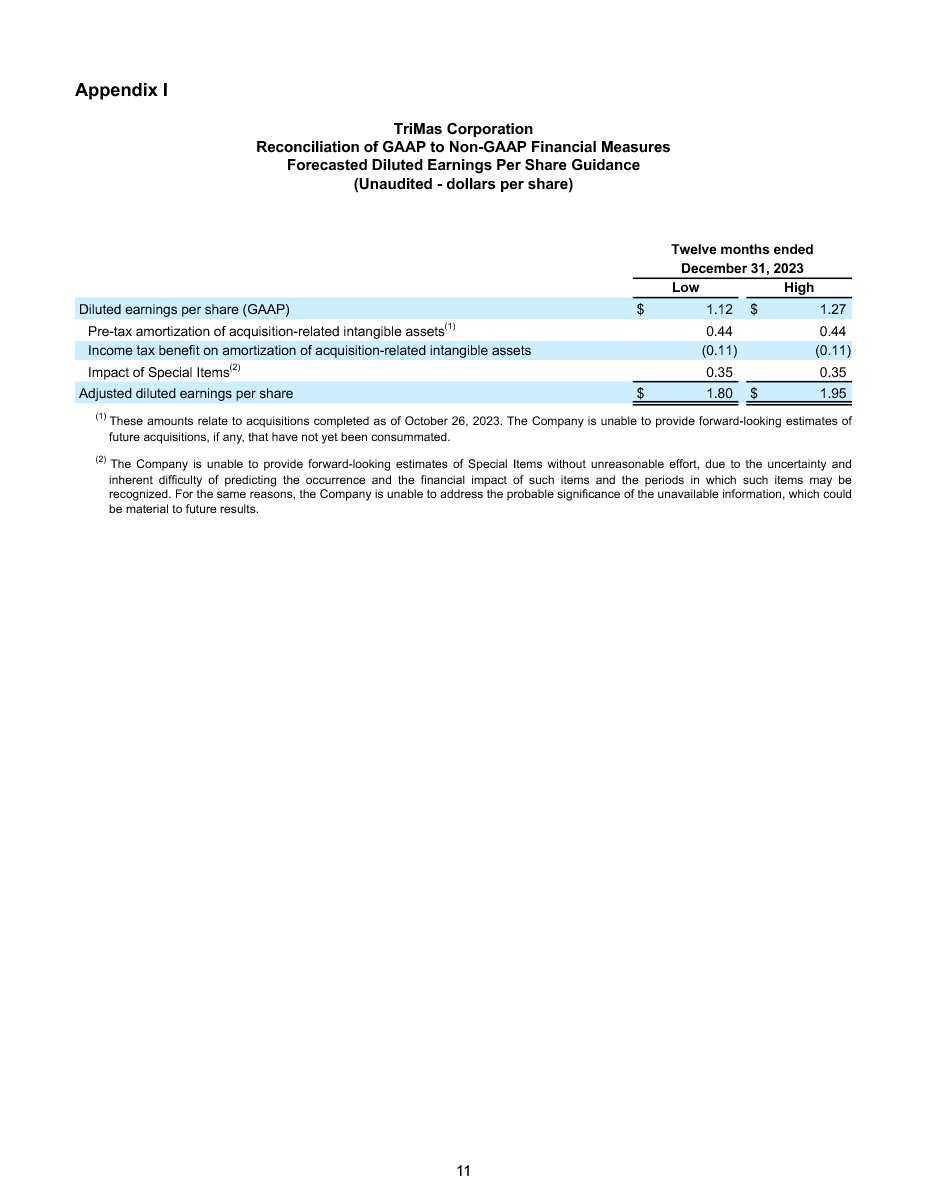

“While we will continue to increase capacity within our TriMas Aerospace group to support market demand, we now expect a longer and more gradual recovery within our TriMas Packaging group, extending into 2024. With that said, we still expect to be within the full year 2023 adjusted diluted EPS(2) guidance range we provided last quarter of $1.80 to $1.95,” said Amato.

The above outlook includes the impact of all announced acquisitions. The outlook provided assumes no detrimental impact related to input costs or end market demand associated with the escalating conflict in the Middle East. All of the above amounts considered as 2023 guidance are after adjusting for any current or future amounts that may be considered Special Items, and in the case of adjusted diluted earnings per share, acquisition-related intangible asset amortization expense for deals that have not yet been consummated. The inability to predict the amount and timing of the impacts of these Special Items makes a detailed reconciliation of these forward-looking non-GAAP financial measures impracticable.(1)

Conference Call Information

TriMas will host its third quarter 2023 earnings conference call today, Thursday, October 26, 2023, at 10 a.m. ET. To participate via phone, please dial (877) 407-0890 (U.S. and Canada) or +1 (201) 389-0918 (outside the U.S. and Canada), and ask to be connected to the TriMas Corporation third quarter 2023 earnings conference call. The conference call will also be simultaneously webcast via the TriMas website at www.trimas.com, under the "Investors" section, with an accompanying slide presentation. A replay of the conference call will be available on the TriMas website or by dialing (877) 660-6853 (U.S. and Canada) or +1 (201) 612-7415 (outside the U.S. and Canada) with a meeting ID of 13741938, beginning October 26, 2023, at 3:00 p.m. ET through November 2, 2023, at 3:00 p.m. ET.

Notice Regarding Forward-Looking Statements

Any "forward-looking" statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, contained herein, including those relating to TriMas’ business, financial condition or future results, involve risks and uncertainties with respect to, including, but not limited to: general economic and currency conditions; the severity and duration of the ongoing coronavirus (“COVID-19”) pandemic; competitive factors; market demand; our ability to realize our business strategies; our ability to identify attractive acquisition candidates, successfully integrate acquired operations or realize the intended benefits of such acquisitions; pressures on our supply chain, including availability of raw materials and inflationary pressures on raw material and energy costs, and customers; the performance of our subcontractors and suppliers; risks and uncertainties associated with intangible assets, including goodwill or other intangible asset impairment charges; risks associated with a concentrated customer base; information technology and other cyber-related risks; risks related to our international operations, including, but not limited to, risks relating to rising tensions between the United States and China; government and regulatory actions, including, without limitation, climate change legislation and other environmental regulations, as well as the impact of tariffs, quotas and surcharges; changes to fiscal and tax policies; intellectual property factors; uncertainties associated with our ability to meet customers’ and suppliers’ sustainability and environmental, social and governance (“ESG”) goals and achieve our sustainability and ESG goals in alignment with our own announced targets; litigation; contingent liabilities relating to acquisition activities; interest rate volatility; our leverage; liabilities imposed by our debt instruments; labor disputes and shortages; the disruption of operations from catastrophic or extraordinary events, including, but not limited to, natural disasters, geopolitical conflicts and public health crises, such as the ongoing coronavirus pandemic; the amount and timing of future dividends and/or share repurchases, which remain subject to Board approval and depend on market and other conditions; our future prospects; and other risks that are detailed in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The risks described are not the only risks facing our Company. Additional risks and uncertainties not currently known to us or that we currently deemed to be immaterial also may materially adversely affect our business, financial position and results of operations or cash flows. These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements, except as required by law.

Non-GAAP Financial Measures

In this release, certain non-GAAP financial measures are used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found in Appendix I at the end of this release. Management believes that presenting these non-GAAP financial measures provides useful information to investors by helping them identify underlying trends in the Company’s businesses and facilitating comparisons of performance with prior and future periods and to the Company’s peers. These non-GAAP financial measures should be considered in addition to, and not as a replacement for or superior to, the comparable GAAP measure, and may not be comparable to similarly titled measures reported by other companies.

Reconciliations of forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures are provided only for the expected impact of amortization of acquisition-related intangible assets for completed acquisitions, as the Company is unable to provide estimates of future Special Items(1) or amortization from future acquisitions without unreasonable effort, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of such items impacting comparability and the periods in which such items may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Additional information is available at www.trimas.com under the “Investors” section.

(1) Appendix I details certain costs, expenses and other amounts or charges, collectively described as "Special Items," that are included in the determination of net income, earnings per share and/or cash flows from operating activities under GAAP, but that management believes should be separately considered when evaluating the quality of the Company’s core operating results, given they may not reflect the ongoing activities of the business.

(2) The Company defines adjusted diluted earnings per share as net income (per GAAP), plus or minus the after-tax impact of Special Items(1), plus the after-tax impact of non-cash acquisition-related intangible asset amortization expense. While the acquisition-related intangible assets aid in the Company’s revenue generation, the Company adjusts for the non-cash amortization expense because the Company believes it (i) enhances management’s and investors’ ability to analyze underlying business performance, (ii) facilitates comparisons of financial results over multiple periods, and (iii) provides more relevant comparisons of financial results with the results of other companies as the amortization expense associated with these assets may fluctuate significantly from period to period based on the timing, size, nature, and number of acquisitions.

(3) The Company defines Net Debt as Total Debt less Cash and Cash Equivalents. Please see Appendix I for additional details.

(4) The Company defines Free Cash Flow as Net Cash Provided by/Used for Operating Activities, excluding the cash impact of Special Items, less Capital Expenditures. Please see Appendix I for additional details.

About TriMas

TriMas manufactures a diverse set of products primarily for the consumer products, aerospace and industrial markets through its TriMas Packaging, TriMas Aerospace and Specialty Products groups. Our approximately 3,500 dedicated employees in 13 countries provide customers with a wide range of innovative and quality product solutions through our market-leading businesses. Our TriMas family of businesses has strong brand names in the markets served, and operates under a common set of values and strategic priorities under the TriMas Business Model. TriMas is publicly traded on the NASDAQ under the ticker symbol “TRS,” and is headquartered in Bloomfield Hills, Michigan. For more information, please visit www.trimas.com.

Contact

Sherry Lauderback

VP, Investor Relations & Communications

(248) 631-5506

This email address is being protected from spambots. You need JavaScript enabled to view it.